Superannuation as the Engine of Lifetime Investing in Australia

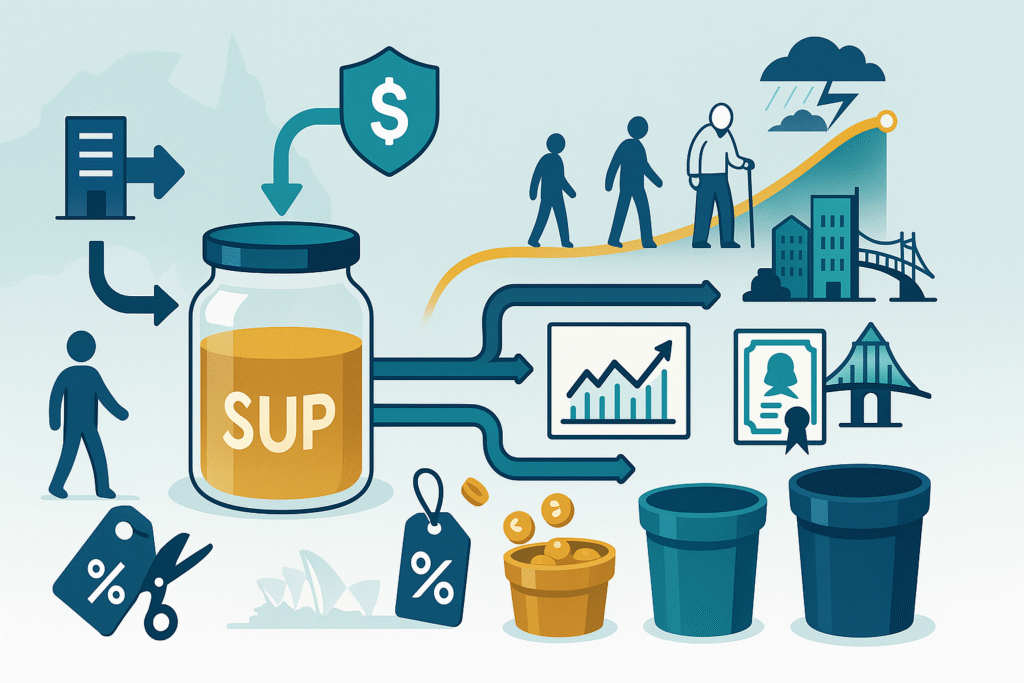

Superannuation sits at the heart of Australia’s wealth-building system, combining disciplined saving, preferential tax treatment, and long-term compounding to fund retirement. At its core, super is both a regulatory framework and an investment vehicle: employers make compulsory contributions (the Superannuation Guarantee, legislated to reach 12%), while individuals may add their own money through concessional and non-concessional contributions. This steady flow of capital, invested across diversified portfolios, is what drives outcomes over decades.

Tax settings are a major reason super matters for investors. Generally, concessional contributions are taxed at a flat rate within the fund, and investment earnings inside super are usually taxed at rates lower than most marginal tax brackets. For long-held assets, there may be discounts on capital gains within the fund. In the retirement (pension) phase, earnings on the portion of super transferred into an income stream can be tax-free, up to a transfer balance cap set by law. These settings make super one of the most efficient structures for compounding wealth over time.

Investment choice is another pillar. Most Australians are in default MySuper options designed to be cost-effective and diversified, often using lifecycle strategies that dial down risk as you age. Others choose tailored options—growth, balanced, conservative, or specialist asset class mixes. Retail, industry, and public sector funds differ on fees, service, and investment approach; self-managed super funds (SMSFs) grant full control and broader assets (like direct property or certain alternatives), but demand compliance sophistication and vigilance on costs.

Risk management within super matters as much as return. Sequencing risk—large losses near retirement—can impair outcomes even with decent average returns, which is why many funds shift to more defensive allocations as members approach retirement. Liquidity risk, manager concentration, and fee drag also shape net performance. Members should review fact sheets, long-term returns after fees and taxes, and the fund’s approach to valuation in illiquid asset classes.

Strategy interacts with structure. Salary sacrifice can reduce personal tax while boosting retirement savings, subject to annual caps that change over time. Spouse contributions and government co-contributions may apply in certain income bands. Downsizer contributions allow eligible retirees to tip proceeds from the sale of a long-term home into super without affecting some caps. Recontribution strategies can alter the taxable/tax-free split of benefits for estate planning efficiency.

Super also integrates insurance—typically life cover, total and permanent disability (TPD), and sometimes income protection—funded from your balance. This can be valuable but review levels, exclusions, and cost, especially for younger members with small balances or older members nearing retirement who may be over-insured.

Retirement is the decumulation test. Many convert to an account-based pension, drawing a mandated minimum percentage each year. The art is balancing sustainability (so the money lasts), investment risk (to preserve purchasing power), and flexibility for changing needs. Some combine a pension with an annuity for longevity protection.

Governance and regulation provide guardrails, with APRA overseeing fund prudence, ASIC supervising disclosure and conduct, and the ATO administering tax and compliance, especially for SMSFs. Rules evolve, so annual caps, eligibility, and thresholds should be checked regularly.

Ultimately, superannuation is not just a savings obligation; it’s Australia’s most powerful investment wrapper. Using its tax settings, diversification options, and disciplined contributions can materially improve retirement outcomes—provided members stay engaged with fees, risk, and strategy as their life circumstances change.